AI in Financial Management for Landscaping Companies

by Willard Moore

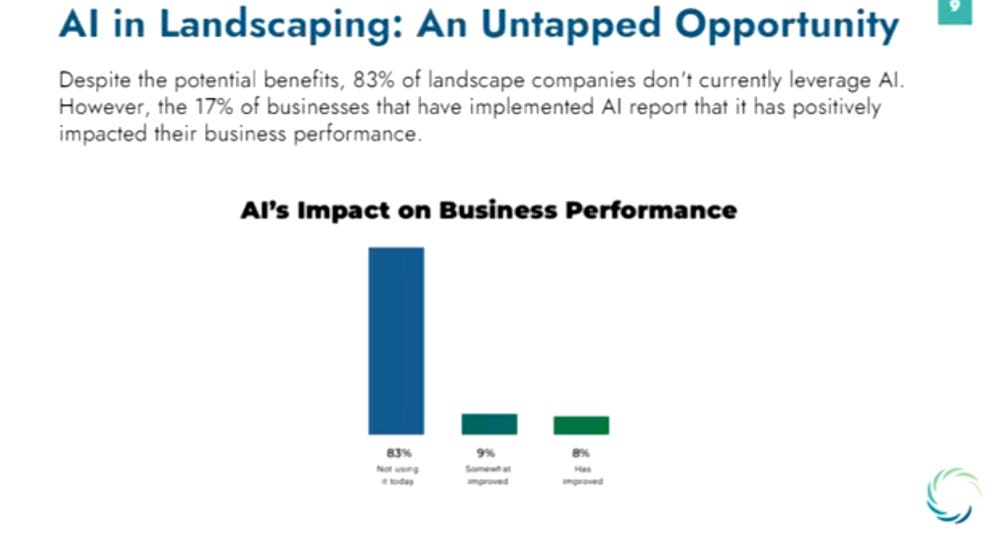

Figure: According to an industry report, 83% of landscape companies aren’t using AI yet, but the 17% that have implemented AI report positive impacts on business performance. Mid-sized landscaping firms (annual revenues $10–$50 million) often juggle multiple software systems for operations and accounting. For example, a company might use Aspire (youraspire.com) for CRM, job costing, and revenue management, and QuickBooks for expenses and general accounting. This split can complicate financial oversight—data gets siloed, reporting is tedious, and manual work creeps in. AI is emerging as a way to bridge these gaps (Aspire Software Blog – Best Landscaping Apps with QuickBooks Integration).

Streamlining System Integration with AI

Integrating operational and accounting systems is a foundational challenge for growing landscaping businesses. Aspire offers strong operational capabilities but does not provide accounting features. It integrates with accounting software like QuickBooks and Acumatica to minimize duplicate data entry. According to Aspire’s documentation, these integrations allow for real-time syncing of data such as job costing and invoicing, helping ensure that information flows efficiently across platforms (Two Twelve Advisors – Aspire Integrations).

While Aspire itself does not currently advertise AI or machine-learning-driven invoice automation (such as OCR document scanning or auto-filled fields), these types of features are available in platforms like QuickBooks via tools like Intuit Assist (Intuit QuickBooks News – Automate your path to growth with Intuit Assist). Aspire focuses more on streamlining job costing, estimating, and syncing invoicing data with accounting platforms rather than embedding native AI for financial automation.

AI-Enhanced Reporting, Forecasting, and Decision-Making

AI tools integrated into accounting software can enhance:

- Real-time reporting through platforms like QuickBooks, where AI generates updated cash flow, income, and expense summaries (QuickBooks Blog – Driving Efficiencies with AI in Accounting).

- Forecasting based on historical patterns and seasonal trends using predictive analytics (FinOptimal – AI Financial Management: 2025 Guide).

- Scenario planning through AI-generated recommendations based on cash flow and budgeting behaviors.

Aspire provides job costing and performance visibility but relies on integrations for advanced financial analytics.

Pain Points of Disconnected Systems (and AI Solutions)

While Aspire integrates with QuickBooks and Acumatica to reduce duplicate entry, the effectiveness of this sync depends heavily on the accuracy of the configuration, discipline in process adherence, and how completely each system is used. Aspire does not automatically resolve all issues related to disconnected systems—it provides a foundation, but integration must be planned, implemented, and maintained actively. Users should be aware that limitations in how Aspire and QuickBooks share data (e.g., manual sync triggers, limited two-way data flow) may require supplemental tools or workflows.

Disconnected systems lead to duplicate entry, inconsistent data, and delayed insights. AI tools like Intuit Assist can improve categorization, automate data entry, and reconcile discrepancies in financial records (Firm of the Future – AI in Accounting for Advisory Firms). Aspire helps mitigate these challenges by syncing critical operational data with accounting platforms but does not offer direct AI enhancements in those areas at this time.

Platforms to Watch

- Aspire: Offers robust operational tools for landscape companies and integrates with QuickBooks and Acumatica for accounting (Aspire Webinar Recap – AI & Predictive Analytics in Landscaping (2025)).

- QuickBooks with Intuit Assist: Adds AI for categorization, reporting, and reminders (QuickBooks Business Blog – Top 7 Ways Small Businesses are Using AI).

Use Cases and Case Studies

- Improved Payment Collection: Businesses using QuickBooks with AI-generated reminders have reported faster customer payments. Intuit states that users leveraging AI reminders get paid 5 days faster on average (Intuit QuickBooks News).

- Expense Categorization Accuracy: With features like automated classification of expenses based on learned patterns, companies reduce the risk of misallocated costs, leading to more accurate financial reports.

- Efficiency in Invoicing: Aspire users benefit from streamlined invoicing workflows via its integration with QuickBooks and its internal tools that assist in managing ready-to-send and overdue invoices (Aspire Software – Invoicing Features).

- EnergyScapes Growth Example: EnergyScapes, a landscape company, generated over $1M in new revenue by using AI-driven property measurement and proposal automation tools (SiteRecon Case Study – EnergyScapes $1M Growth with AI).

Benefits and Limitations of AI Technologies

Benefits

- Time and Cost Savings: AI reduces time spent on routine tasks like data entry and invoice tracking, freeing up staff for strategic work.

- Improved Accuracy: Automating categorization and reconciliation can reduce errors from manual input.

- Enhanced Decision Support: Tools like Intuit Assist provide suggestions and insights that help owners make timely, informed financial decisions.

- Scalability: As companies grow, AI tools scale without requiring proportional increases in administrative staff.

Limitations

- Data Dependency: AI outputs are only as good as the quality of input data. Inconsistent practices across platforms can undermine reliability.

- Trust and Oversight: AI tools still require human verification and adjustment to ensure their recommendations make practical business sense.

- Integration Complexity: While Aspire offers integrations, setting them up and maintaining them requires operational diligence.

- No Native AI in Aspire: Aspire does not currently support AI-driven financial automation; companies must rely on integrations with platforms like QuickBooks for those capabilities.

Summary

The Aspire platform from youraspire.com is a powerful operational tool tailored to landscape businesses, but it does not currently feature AI-powered document scanning or invoice field automation. For businesses seeking those specific AI features, integrating Aspire with accounting platforms like QuickBooks (which does offer those capabilities) is a best practice. Accurate financial management for landscaping companies in the $10–$50M range depends on seamless integration, reliable data flows, and the strategic use of AI-enhanced accounting tools.

All Aspire-related references in this article are based exclusively on features publicly available at youraspire.com.

How to Get Started

If you are unsure where to begin applying AI to your finances, consider starting with these three steps:

- Inventory Your Systems: List all tools you’re currently using for operations, accounting, estimating, and reporting. Understand what data lives where. (This process is known as creating a data flow diagram, DFD.)

- Identify Bottlenecks: Look for any processes where data is being duplicated, delayed, or manually managed. Examples might include invoice entry, expense categorization, or job cost reconciliation.

- Start Small with AI: Tools like QuickBooks with Intuit Assist offer low-barrier access to AI. Start by turning on features like automated categorization, cash flow projections, or reminders for overdue invoices. These incremental improvements can free up time and highlight where deeper automation is possible.

How We Can Help

If you are currently using Aspire and QuickBooks—or considering either—we can help you go beyond tool adoption to true system alignment. Our team includes a fractional CFO, Steve Steele from Wilson360, who specializes in integrating these platforms and generating meaningful financial reports. For clients needing deeper automation and custom workflows, Willard Moore provides technology-led solutions focused on syncing tools, automating financial tasks, and reducing admin overhead.

We help landscaping companies turn disconnected tools into streamlined, automated systems that improve visibility and support growth. Whether you need to tighten reporting or implement “done-for-you” automations, we have the people and playbooks to guide your next step.

- Learn more about Steve Steelefor CFO and reporting strategy.

- Learn more about Willard Moorefor CTO and automation/integration strategy.

Reach out to start simplifying your tech stack and taking control of your financial systems.

W360 Tech Corner features Willard Moore, Wilson360 CTO, breaking down the latest trends and innovations transforming businesses—from AI to performance tools—keeping you ahead of the curve. Connect with Willard at [email protected].