The post Building Smarter Crews with Real-Time Data: A Conversation with Sean Eddy of TOP Green appeared first on WILSON360.

]]>We sat down with Sean Eddy, Account Executive at TOP Green, to talk about how smarter systems are closing that gap. With real-time data, AI-powered insights, and predictive planning tools, Sean and his team are helping contractors reduce inefficiencies, improve accountability, and make confident decisions faster. His perspective is especially relevant for companies that want to grow without adding complexity, and for leaders who know it’s time to stop flying blind when it comes to field performance.

What’s the biggest challenge you see in field operations right now?

Sean Eddy: The lack of real-time visibility. Most contractors don’t find out what went wrong on a jobsite until after the day ends, sometimes even days later. By that point, you’ve lost any chance to fix it. The feedback loop is just too slow. You’re relying on end-of-day reports, phone calls, or secondhand updates from foremen who are already juggling too much. The biggest opportunity we see is helping leaders shift from reactive to proactive, by giving them access to real-time data from their job sites to adjust on the fly.

What does that visibility actually look like for a contractor?

Sean Eddy: It starts with a solid daily plan—crews know exactly what they’re expected to accomplish, and leadership knows where everyone is and what they’re doing. From there, it’s about live dashboards and performance metrics. Contractors can see if tasks are ahead, behind, or on pace. If something goes sideways—like a delay, missing equipment, or crew shortage—they can deal with it right then, not after it’s cost them a day’s margin. It also helps crew leaders feel more supported. They’re not just being tracked—they’re being equipped to succeed.

What kind of results have you seen from companies that’ve adopted this approach?

Sean Eddy: You see higher accountability almost immediately. Crews know their time and progress are visible, making a difference. One company went from weekly reviews to daily stand-ups, which actually meant something. They used the data to coach in real time, not just review what went wrong. Managers stopped micromanaging because they had the information they needed without hovering. Another client told me it helped them spot crew training needs earlier, and that helped reduce callbacks. The ripple effect is big—fewer delays, clearer expectations, and better jobsite outcomes overall.

What role does AI play in the process?

Sean Eddy: AI takes the raw data and turns it into usable intelligence. It spots patterns across properties and crews, like where your estimates consistently fall short, or which teams consistently outperform. For a growing company, that kind of insight is invaluable. It helps leaders allocate resources better, identify bottlenecks, and even refine how they price labor. AI doesn’t replace field leadership, but it helps those leaders make smarter decisions. It’s the difference between relying on memory or instinct and having a system that tells you what’s really happening and what to do next.

For leaders trying to grow without adding layers of management, where should they start?

Sean Eddy: Start by collecting the right data. You don’t need a complex system on day one—just a way to capture what’s happening on your jobsites. That could be as simple as tracking daily production against your plan. Once the data starts coming in, it creates momentum. You start seeing where you’re over or underestimating, where time is being lost, and where your strongest crews are. That insight becomes fuel for better planning. It also builds trust, because when your team knows decisions are based on facts, not frustration, conversations change. Culture improves. Performance improves.

As the green industry evolves, operational clarity becomes the foundation for sustainable growth. Leaders who embrace data, not just for reporting, but for decision-making, are setting a new standard. At this year’s Thought Leaders Retreat (TLR25), Wilson360 and TOP Green will take the conversation deeper, highlighting the tools, strategies, and leadership shifts driving real transformation in field operations.

Listen to the full episode of the Commercial Landscaper Podcast here.

TOP Green gives commercial landscape companies real-time visibility into crew performance and jobsite progress, powered by smart data and AI. Learn more at topgreen.ai

Wilson360 helps landscape companies grow with intention—through strategic peer groups, coaching, and real-world leadership tools. Learn more at wilson-360.com

The post Building Smarter Crews with Real-Time Data: A Conversation with Sean Eddy of TOP Green appeared first on WILSON360.

]]>The post Building Financial Strength: How Leaders Drive Profit & Resilience appeared first on WILSON360.

]]>In endurance racing, success doesn’t come from luck — it comes from consistent, focused management where discipline fuels long-term profitability. Businesses navigating today’s economic uncertainties face the same test. While some leaders freeze or chase short-term fixes, the strongest see these moments as unique opportunities to sharpen their systems, lead with clarity, and strengthen long-term profitability.

In The Ironman Mindset for Entrepreneurs, I emphasize that endurance leadership isn’t just about surviving — it’s about thriving when others falter. Financial management is no exception.

The Mindset of Financial Endurance

Strong financial management is more than spreadsheets — it’s a mindset. Uncertainty around costs, talent, and market shifts creates a landscape where reactive leaders struggle, but disciplined leaders gain ground.

When you adopt a financial endurance mindset, you:

- Build cash reserves not out of fear, but to position yourself for future investment

- Focus spending on what truly drives results, cutting distractions that drain resources

- View periods of uncertainty as chances to reassess, realign, and strengthen — not just hold the line

Ignore the noise coming from headlines and financial markets. Real leadership means tuning in to your clients—what they’re saying, how they’re responding—and pivoting accordingly. That’s where your decisions should come from.

Know Your Numbers, Know Your Course

You can’t lead what you don’t understand. Just like an athlete checks their pace and fueling strategy mid-race, a business leader must regularly check key financial metrics to stay on course — especially when the external landscape changes.

What should you track?

- Profit margins across divisions, services, or clients

- Cash flow, ensuring the timing of money supports operational needs

- Debt and obligations, allowing for strategic negotiation or restructuring

- Use tools like a 13-week cash flow forecast to maintain visibility and plan with confidence

Leaders who consistently monitor these numbers don’t just stay afloat; they’re ready to act when openings appear.

Empower Your Team with Financial Insight

Leadership isn’t about carrying the whole load alone. In fact, the most resilient businesses are those where teams understand the company’s financial priorities and align their efforts accordingly.

Many companies miss a huge opportunity by keeping teams in the dark about financial goals or pressures, limiting innovation and accountability. To build a culture where financial strength is a shared responsibility, leaders must:

- Share clear, actionable financial goals

- Provide training so employees understand how their work connects to costs and outcomes

- Recognize and reward financially smart decisions

This approach moves financial strength from the back office into the heart of the entire organization.

Build Systems, Not Fire Drills

Uncertainty exposes one thing quickly: which businesses operate on real systems and which survive on sheer willpower.

To weather unpredictable times, you need systems that create consistency and resilience:

- Budgeting processes that reflect both current realities and future ambitions

- Forecasting tools to map out best- and worst-case scenarios

- Regular reviews that ensure you’re not steering by gut alone

Strong systems don’t eliminate uncertainty — they make you adaptable within it.

Final Thoughts: Financial Strength Is Leadership Strength

Here’s the truth: economic uncertainty doesn’t weaken every business equally. The leaders who embrace disciplined financial management, leverage uncertainty as opportunity, and focus on what they can control will come out ahead — stronger, more profitable, and better prepared for whatever comes next.

In uncertain times, your team looks to you for certainty. Owners and CEOs must be steady, visible, and confident. That kind of leadership builds trust—and it keeps your business grounded when others are reacting.

To go the distance, you can’t leave your financial strategy to chance. Build it, lead it, and own it.

When you’re ready for more structure and less stress, Wilson360 works with owners and leadership teams to strengthen systems and build lasting profitability. Request our 13-week cash flow projector to get started. Connect: [email protected] | wilson-360.com/services

The post Building Financial Strength: How Leaders Drive Profit & Resilience appeared first on WILSON360.

]]>The post Where Insight Meets Impact: Why TLR 2025 Matters More Than Ever appeared first on WILSON360.

]]>“We’re not going back to the way we used to do things.”

He’d come looking for ideas. He left with a strategy, three new industry connections, and a clear roadmap for his team.

That’s what happens at TLR.

This July, the industry’s most forward-thinking leaders will gather again—July 28–30, at the Four Seasons in Denver—for a retreat built specifically for owners and executives navigating change, competition, and opportunity.

Not Just Another Conference

TLR isn’t about theory or recycled keynotes. It’s about what’s actually working—right now—in growth-minded landscape businesses. Whether you’re leading a $5–15M company building infrastructure for scale or a Top 100 firm looking to push into new markets, TLR offers an environment where strategy, candor, and collaboration come first.

You’ll hear from people like:

- Bruce Wilson, who’s helped dozens of companies break through growth ceilings

- Ross Shafer, speaking on how adaptive leadership outpaces disruption

- Bob Grover, offering hard-won insight from decades in the field

Expect focused sessions, breakout groups, and unfiltered discussions that challenge assumptions and lead to real action.

Designed for Growth-Stage Companies

Every year, more leaders from smaller, fast-growing companies attend—and for good reason.

Sessions are designed to address real-time issues like:

- Leading through complexity and expansion

- Developing leaders who can carry your vision

- Building sustainable systems that reduce friction as you grow

One attendee called it a “turning point” in their company’s story. That’s the goal.

The Right People in the Room

TLR isn’t about who you meet—it’s about who you build with. Whether it’s over a drink at the poolside “Network & Chill” or during our Industry Partner Showcase, the connections made here often lead to partnerships, acquisitions, and creative problem-solving long after the event ends.

Don’t Miss This Moment

With only 63 seats left and the Four Seasons discounted rate expiring June 25, this is the window to act. Last year sold out six weeks early.

📍 https://events.wilson-360.com/tlr2025

📧 Questions? Contact Joe Kujawa at [email protected]

This is more than a retreat. It’s a launchpad. And your next move could start here.

The post Where Insight Meets Impact: Why TLR 2025 Matters More Than Ever appeared first on WILSON360.

]]>The post AI in Financial Management for Landscaping Companies appeared first on WILSON360.

]]>

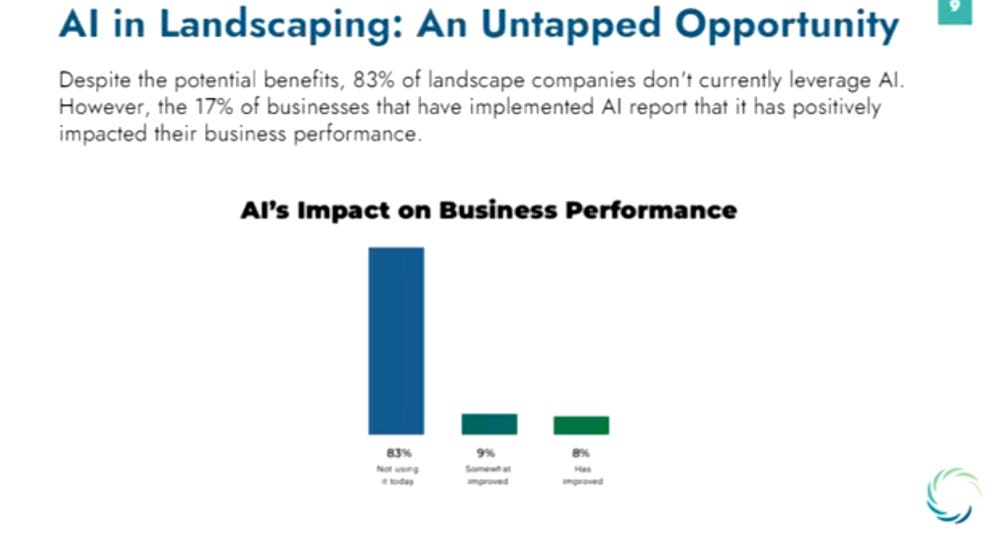

Figure: According to an industry report, 83% of landscape companies aren’t using AI yet, but the 17% that have implemented AI report positive impacts on business performance. Mid-sized landscaping firms (annual revenues $10–$50 million) often juggle multiple software systems for operations and accounting. For example, a company might use Aspire (youraspire.com) for CRM, job costing, and revenue management, and QuickBooks for expenses and general accounting. This split can complicate financial oversight—data gets siloed, reporting is tedious, and manual work creeps in. AI is emerging as a way to bridge these gaps (Aspire Software Blog – Best Landscaping Apps with QuickBooks Integration).

Streamlining System Integration with AI

Integrating operational and accounting systems is a foundational challenge for growing landscaping businesses. Aspire offers strong operational capabilities but does not provide accounting features. It integrates with accounting software like QuickBooks and Acumatica to minimize duplicate data entry. According to Aspire’s documentation, these integrations allow for real-time syncing of data such as job costing and invoicing, helping ensure that information flows efficiently across platforms (Two Twelve Advisors – Aspire Integrations).

While Aspire itself does not currently advertise AI or machine-learning-driven invoice automation (such as OCR document scanning or auto-filled fields), these types of features are available in platforms like QuickBooks via tools like Intuit Assist (Intuit QuickBooks News – Automate your path to growth with Intuit Assist). Aspire focuses more on streamlining job costing, estimating, and syncing invoicing data with accounting platforms rather than embedding native AI for financial automation.

AI-Enhanced Reporting, Forecasting, and Decision-Making

AI tools integrated into accounting software can enhance:

- Real-time reporting through platforms like QuickBooks, where AI generates updated cash flow, income, and expense summaries (QuickBooks Blog – Driving Efficiencies with AI in Accounting).

- Forecasting based on historical patterns and seasonal trends using predictive analytics (FinOptimal – AI Financial Management: 2025 Guide).

- Scenario planning through AI-generated recommendations based on cash flow and budgeting behaviors.

Aspire provides job costing and performance visibility but relies on integrations for advanced financial analytics.

Pain Points of Disconnected Systems (and AI Solutions)

While Aspire integrates with QuickBooks and Acumatica to reduce duplicate entry, the effectiveness of this sync depends heavily on the accuracy of the configuration, discipline in process adherence, and how completely each system is used. Aspire does not automatically resolve all issues related to disconnected systems—it provides a foundation, but integration must be planned, implemented, and maintained actively. Users should be aware that limitations in how Aspire and QuickBooks share data (e.g., manual sync triggers, limited two-way data flow) may require supplemental tools or workflows.

Disconnected systems lead to duplicate entry, inconsistent data, and delayed insights. AI tools like Intuit Assist can improve categorization, automate data entry, and reconcile discrepancies in financial records (Firm of the Future – AI in Accounting for Advisory Firms). Aspire helps mitigate these challenges by syncing critical operational data with accounting platforms but does not offer direct AI enhancements in those areas at this time.

Platforms to Watch

- Aspire: Offers robust operational tools for landscape companies and integrates with QuickBooks and Acumatica for accounting (Aspire Webinar Recap – AI & Predictive Analytics in Landscaping (2025)).

- QuickBooks with Intuit Assist: Adds AI for categorization, reporting, and reminders (QuickBooks Business Blog – Top 7 Ways Small Businesses are Using AI).

Use Cases and Case Studies

- Improved Payment Collection: Businesses using QuickBooks with AI-generated reminders have reported faster customer payments. Intuit states that users leveraging AI reminders get paid 5 days faster on average (Intuit QuickBooks News).

- Expense Categorization Accuracy: With features like automated classification of expenses based on learned patterns, companies reduce the risk of misallocated costs, leading to more accurate financial reports.

- Efficiency in Invoicing: Aspire users benefit from streamlined invoicing workflows via its integration with QuickBooks and its internal tools that assist in managing ready-to-send and overdue invoices (Aspire Software – Invoicing Features).

- EnergyScapes Growth Example: EnergyScapes, a landscape company, generated over $1M in new revenue by using AI-driven property measurement and proposal automation tools (SiteRecon Case Study – EnergyScapes $1M Growth with AI).

Benefits and Limitations of AI Technologies

Benefits

- Time and Cost Savings: AI reduces time spent on routine tasks like data entry and invoice tracking, freeing up staff for strategic work.

- Improved Accuracy: Automating categorization and reconciliation can reduce errors from manual input.

- Enhanced Decision Support: Tools like Intuit Assist provide suggestions and insights that help owners make timely, informed financial decisions.

- Scalability: As companies grow, AI tools scale without requiring proportional increases in administrative staff.

Limitations

- Data Dependency: AI outputs are only as good as the quality of input data. Inconsistent practices across platforms can undermine reliability.

- Trust and Oversight: AI tools still require human verification and adjustment to ensure their recommendations make practical business sense.

- Integration Complexity: While Aspire offers integrations, setting them up and maintaining them requires operational diligence.

- No Native AI in Aspire: Aspire does not currently support AI-driven financial automation; companies must rely on integrations with platforms like QuickBooks for those capabilities.

Summary

The Aspire platform from youraspire.com is a powerful operational tool tailored to landscape businesses, but it does not currently feature AI-powered document scanning or invoice field automation. For businesses seeking those specific AI features, integrating Aspire with accounting platforms like QuickBooks (which does offer those capabilities) is a best practice. Accurate financial management for landscaping companies in the $10–$50M range depends on seamless integration, reliable data flows, and the strategic use of AI-enhanced accounting tools.

All Aspire-related references in this article are based exclusively on features publicly available at youraspire.com.

How to Get Started

If you are unsure where to begin applying AI to your finances, consider starting with these three steps:

- Inventory Your Systems: List all tools you’re currently using for operations, accounting, estimating, and reporting. Understand what data lives where. (This process is known as creating a data flow diagram, DFD.)

- Identify Bottlenecks: Look for any processes where data is being duplicated, delayed, or manually managed. Examples might include invoice entry, expense categorization, or job cost reconciliation.

- Start Small with AI: Tools like QuickBooks with Intuit Assist offer low-barrier access to AI. Start by turning on features like automated categorization, cash flow projections, or reminders for overdue invoices. These incremental improvements can free up time and highlight where deeper automation is possible.

How We Can Help

If you are currently using Aspire and QuickBooks—or considering either—we can help you go beyond tool adoption to true system alignment. Our team includes a fractional CFO, Steve Steele from Wilson360, who specializes in integrating these platforms and generating meaningful financial reports. For clients needing deeper automation and custom workflows, Willard Moore provides technology-led solutions focused on syncing tools, automating financial tasks, and reducing admin overhead.

We help landscaping companies turn disconnected tools into streamlined, automated systems that improve visibility and support growth. Whether you need to tighten reporting or implement “done-for-you” automations, we have the people and playbooks to guide your next step.

- Learn more about Steve Steelefor CFO and reporting strategy.

- Learn more about Willard Moorefor CTO and automation/integration strategy.

Reach out to start simplifying your tech stack and taking control of your financial systems.

W360 Tech Corner features Willard Moore, Wilson360 CTO, breaking down the latest trends and innovations transforming businesses—from AI to performance tools—keeping you ahead of the curve. Connect with Willard at [email protected].

The post AI in Financial Management for Landscaping Companies appeared first on WILSON360.

]]>The post Wilson 360: 2024 landscape industry benchmark appeared first on WILSON360.

]]>Annually, a variety of industry partners roll out their annual reports packed with critical insights into the latest business trends, the future industry outlook and key observations that help set clear expectations for the road ahead.

For over 15 years, Wilson 360 has been leading our own annual benchmarking charge, comprised of commercial and residential operators coast to coast ranging from $3 million to $54 million annually. For the first time ever, we are sharing some of our own exclusive insights into the health of the industry based on same-company year-over-year results from 2024. What follows is an exciting glimpse into where the industry stands and where it is heading.

Total Revenue, Expenses and Gross Margin

Revenue. Total Net Revenue (Gross Revenue – Subcontract costs) increased 8%, a slight reduction versus 2023’s gains of 9%. The industry continued to benefit from a strong economy with property managers focused on keeping properties looking good and homeowners’ continued investment into their biggest asset.

Cost of Goods Sold (COGS). COGS, costs directly related to job-level field production activities, was 47% of Net Revenue, down 4% versus 2023. Green industry companies continued emphasizing more efficient production and benefited from stabilizing wages and material costs.

Direct Labor. Direct Labor is the biggest controllable variable cost for most companies. Overall, burdened Direct Labor costs were comparable to 2023, comprising 31% of Net Revenue. Cost reductions resulting from greater efficiency directly increase Net Operating Income, assuming overhead costs remain consistent as a percentage of Net Revenue.

Gross Margin. Gross Margin (Net Revenue – COGS), increased 4% compared to 2023, to 53% of Net Revenue. This critical number is what remains to pay for all overheads and net operating income.

Net Operating Income. Net Operating Income, income derived specifically from a company’s core business operations before other income and expense items, increased 31% over 2023, totaling 7% of Net Revenue. Gains resulted from better operating efficiency leading to reduced COGS and better overhead economies of scale related to revenue growth.

Maintenance. Maintenance continued to show robust annual growth. This key division grew 19% over 2023, comprising 43% of Net Revenue. Pricing stabilized, though companies more than ever realized the need to keep up with their own increased costs of production, becoming more strategic about how price increases are levelled on their client base. Burdened Direct Labor percentage of Net Revenue declined 7% versus 2023, totaling 43% of Net Revenue, while Gross Margin improved 3% over 2023, finishing at 51% of Net Revenue.

Enhancement. Generally, enhancement sales started slowly in 2024, in some cases until the latter part of the year, which helps explain the lackluster 2% growth results in this area. Burdened Direct Labor percentage of Net Revenue fell 5% compared to 2023, finishing at 22% of Net Revenue, while Gross Margin improved 2% versus 2023, at 65% of Net Revenue.

Enhancement Revenue Percentage of Maintenance Revenue. Sometimes called Enhancement Penetration Percentage, it is a critical measure of how effectively property upgrades are provided to a captive maintenance client base. Enhancement proposals are less price sensitive and when completed, result in higher satisfaction with the overall appearance of the property, leading to potentially higher maintenance retention percentages.

Enhancement Revenue was 30% of Maintenance Revenue, which is level compared to 2023. This indicates some possible softness in consumer sentiment during an election year full of domestic and geopolitical unrest.

2025 Outlook. Concerning headwinds, a by-product of U.S. economic instability related to tariffs and federal job reduction impacts, are causing uncertainty related to non-core maintenance services, primarily enhancement and other related elective services, at the midway point of Q2. Assessing potential budget impacts will take time for property owners and service providers. Lagging effects of this uncertainty may continue through mid-Q3, though by late Q3, the outlook should stabilize, allowing a clearer indication of how 2025 will finish and highlighting key economic considerations heading into 2026.

Reprinted with permission. GIE Media. Lawn & Landscape May 2025 (c)

The post Wilson 360: 2024 landscape industry benchmark appeared first on WILSON360.

]]>The post Smarter Estimating, Stronger Teams appeared first on WILSON360.

]]>But that’s precisely what drew Michael Ding, founder and CEO of Bobyard, to it. A Stanford-trained technologist, Michael saw how AI could turn one of the industry’s most painful bottlenecks into a smarter, faster, and more sustainable process.

We caught up with him ahead of TLR25, where Bobyard will join the Wilson360 annual event, to share how AI is reshaping the way landscape companies estimate—and why this shift is just the beginning.

AI is streamlining takeoffs and estimates, unlocking time for teams, and reshaping how landscaping companies win business.

Why focus Bobyard on landscaping?

Michael Ding:

We started by training AI models across multiple trades—mechanical, plumbing, electrical—but landscaping stood out. The plans are complex. The takeoff counts are huge. Tens of thousands of items per project, in some cases.

That made it a clear opportunity for automation. People don’t love spending hours counting plants, and those hours add up fast. We saw a clear opportunity to remove that burden, improve accuracy, and give teams their time back.

What does AI-powered estimating look like in practice?

Michael:

It’s like handing your plan sets to an extremely fast, extremely accurate junior estimator. The model reads the drawings, understands the symbols and quantities, and automatically builds the takeoff.

It’s not about replacing your team—it’s about helping them focus on higher-value work. Many of our clients save 50% or more on estimating time without hiring additional staff.

How are your most successful clients using the time they’re saving?

Michael:

It varies, but the pattern is clear—they’re reinvesting that time into growth. That might mean bidding more jobs, improving margins, or simply giving their team a more manageable workload. One of the most overlooked benefits is energy. When low-leverage tasks don’t bog down your top people, they bring more creativity, focus, and accountability to the table.

For leaders who feel behind on AI, where should they start?

Michael:

Start small. This doesn’t have to be overwhelming. If you’ve ever typed instructions or used a search bar, you already know how to use AI.

Pick one area of your business where you’re losing time—writing, estimating, even organizing files—and test how AI can support that task. It’s about learning, not replacing. Once you see what’s possible, you’ll know where to go next.

Why is this important now?

Michael:

Because the landscape is shifting. The companies adopting AI aren’t just moving faster—they’re becoming more efficient, more strategic, and more scalable.

We’re well past the early-adopter phase. This is already happening. And the longer companies wait, the harder it becomes to catch up.

Looking Ahead

Bobyard isn’t just solving a technical problem—it’s helping landscape companies scale smarter by freeing up time, sharpening focus, and keeping great people engaged in meaningful work.

Michael will be joining us at Wilson360’s Thought Leaders Retreat in July, where peers and partners across the industry will gather to exchange ideas, challenge assumptions, and build what’s next—together.

Because success isn’t just about growing faster—it’s about making space for the work that matters most.

Bobyard is a modern takeoff and estimating platform powered by AI—built specifically for landscaping professionals. Learn more at bobyard.com

Wilson360 helps landscape companies grow with intention—through strategic peer groups, coaching, and real-world leadership tools. Learn more at wilson-360.com

The post Smarter Estimating, Stronger Teams appeared first on WILSON360.

]]>The post Built to Last: What Business Sustainability Really Looks Like appeared first on WILSON360.

]]>In The Ironman Mindset for Entrepreneurs, I talk about playing the long game—training with purpose, sticking to your plan, and staying focused when the excitement wears off. That same mindset is the difference between a business that survives a few good years and one that creates lasting value.

What Sustainability in Business Really Means

Too often, business sustainability gets confused with profitability. But sustainable businesses go beyond the bottom line:

- They develop leaders at every level, not just at the top.

- They build systems that work without constant firefighting.

- They make decisions today that their future selves can live with.

Sustainability isn’t just a goal. It’s a discipline.

The Warning Signs of Fragile Growth

I’ve worked with hundreds of business owners. You can feel when a company’s growth is surface-level—when the wheels fall off the moment the owner steps away. That’s not sustainability. That’s risk disguised as success.

Here are a few signs the foundation needs work:

- You’re still the only one making critical decisions.

- Your revenue depends too heavily on a few clients—or one key person.

- You’re growing, but your systems and people can’t keep up.

How to Build a Business That Lasts

Sustainable businesses are led with intention. They’re not perfect, but they’re built with a mindset that prepares them for what’s next—not just what’s now. Start here:

- Build Bench Strength

Train people to lead—not just follow. The business should run without you in the room. - Create Repeatable Systems

If every decision is custom, nothing scales. Document your process, refine it, and make it transferable. - Diversify Your Risk

Whether it’s client mix, service lines, or internal talent, avoid single points of failure. - Protect Energy—Yours and Theirs

You can’t lead well if you’re burned out. Neither can your team. Sustainable pace creates sustainable performance.

Final Thoughts: Sustainable Means Transferable

A truly sustainable business is one that could be handed off—whether to a team, a successor, or a buyer—and continue to grow. That doesn’t happen by chance. It’s the product of mindset, planning, and the discipline to build beyond yourself.

If your business can’t run without you, it’s time to start building one that can. I work with owners and leadership teams who want to create lasting value through structure, strategy, and staying power. Reach me at [email protected] or learn more at wilson-360.com/services.

The post Built to Last: What Business Sustainability Really Looks Like appeared first on WILSON360.

]]>The post Greener by Design: How Landscaping Tech Is Driving Environmental Sustainability appeared first on WILSON360.

]]>For account managers, estimators, operations leaders, and owners, tech enables a shift toward smarter, cleaner, and more efficient practices—without compromising performance or profitability. Here’s a look at how emerging tools and platforms make that possible.

Smart Irrigation and Water Management

Water is one of the most critical and heavily regulated resources in landscaping. Today’s irrigation systems aren’t just on timers—they’re powered by real-time data, predictive weather modeling, and responsive soil sensors.

These systems help landscaping companies dramatically reduce water waste while improving plant health and long-term maintenance outcomes. In drought-prone regions, they’re not just efficient—they’re essential. For account managers and crews, remote control via mobile dashboards makes adjustments faster and more precisely.

Electric and Battery-Powered Equipment

The shift away from gas-powered machines toward electric and battery-powered equipment is gaining serious ground. These tools not only reduce emissions and fuel consumption, they also lower noise pollution—an increasingly important factor in urban and HOA-governed neighborhoods.

For crews, these machines are lighter and require less maintenance. For the business, they signal a visible commitment to sustainability that many clients now look for when choosing a service partner.

Carbon Tracking and Sustainability Reporting

Sustainability isn’t just about practice—it’s also about proof. More businesses are adopting digital tools to monitor their environmental footprint, track carbon output, and build reports that align with internal goals or client requirements.

Whether it’s fuel usage, energy consumption, or materials waste, these insights help landscaping companies benchmark their performance and stay accountable. This data is increasingly valuable in winning contracts, meeting compliance standards, and building trust with environmentally conscious clients.

Autonomous and Efficient Operations

From self-guided mowing systems to optimized routing software, automation reshapes how teams deliver landscaping services. These technologies reduce idle time, lower emissions, and better use limited labor resources.

They also increase consistency in service delivery, which benefits both the business and the client. For leaders focused on long-term growth, these tools support leaner operations while advancing environmental goals.

Final Thoughts

Environmental sustainability is more than an aspiration—it’s fast becoming a competitive advantage, if not already.. Landscaping companies that embrace tech-forward solutions are not only reducing their environmental impact, they’re building smarter, more resilient businesses.

The future of landscaping will be measured not just in square footage, but in water saved, emissions reduced, and long-term value created. Technology is how we’ll get there.

W360 Tech Corner features Willard Moore, Wilson360 CTO, breaking down the latest trends and innovations transforming businesses—from AI to performance tools—keeping you ahead of the curve. Connect with Willard at [email protected].

The post Greener by Design: How Landscaping Tech Is Driving Environmental Sustainability appeared first on WILSON360.

]]>The post 5 Ways to Hire Lawn Care Employees Efficiently appeared first on WILSON360.

]]>From highlighting career growth to creating a healthy culture, Sheila Matthews explains why it’s a struggle to answer the question, “How do I hire lawn care employees?”

Over 60% of Gen Z actively engage in outdoor sports, and a growing number are considering hands-on trades over traditional desk jobs. So why is the landscaping industry struggling to attract early career talent? The answer might surprise you.

The labor shortage isn’t new — but the challenge of attracting younger workers is growing. Gen Z is eager for opportunities, yet landscaping isn’t on their radar. That needs to change. The industry can’t afford to rely on outdated hiring tactics. Instead, businesses must intentionally connect with the next generation of professionals. They are looking for work that matters and landscaping offers exactly that — but only if they see it.

If your company is still struggling to attract early career talent, you may be asking, “How do I hire lawn care employees?” Here’s five ways to get rolling in the right direction.

Emphasize purpose & sustainability

Gen Z wants meaningful work. They care about the environment and want to be part of the solution. Position landscaping as a career that directly impacts communities, fights climate change and creates healthier outdoor spaces. Rethink your hiring message — promote eco-friendly initiatives. Every role, from entry-level to leadership, should be tied to a bigger purpose.

Too often, younger workers see landscaping as just mowing lawns. To hire good lawn care employees, companies need to shift that perception by showcasing the long-term impact of their work.

Showcase career growth & stability

Gen Z isn’t looking for a dead-end job. They want a future. Make career paths clear by explaining how a laborer can become a crew lead, move into management and eventually grow into senior leadership. Share real success stories from your team featuring employees who you hired that have advanced within your company.

Go a step further by involving younger employees in the interview process when hiring new workers. Seeing a peer who has progressed within the company makes career growth feel more tangible. Companies should also highlight leadership training, apprenticeship programs or certifications that help hired employees move up faster.

Update your recruiting & hiring process

If your hiring process is slow, outdated or not mobile-friendly, you’re losing candidates before they even apply. Gen Z expects speed, convenience and transparency. Companies should focus on mobile-friendly applications and quick-response help you find ways how to hire lawn care employees. Job postings for lawn care employees should be placed on platforms where Gen Z is already searching.

Short-form videos showcasing a day in the life of a landscaper can help bridge the gap between perception and reality. Show what the work really looks like — highlight teamwork, outdoor problem-solving and opportunities to gain valuable skills. And if your company isn’t active on social media, it is invisible to most job seekers. TikTok, Instagram and LinkedIn should be used to highlight team culture, projects and career opportunities.

Offer competitive pay & benefits

Purpose matters, but so does financial security. Companies should evaluate their pay structures and ensure they align with regional market standards. Referral bonuses and performance-based raises can keep early career workers engaged. Addressing seasonality is also important, and businesses should consider partnerships with companies like UPS or Amazon to provide winter job options. Many companies have successfully transitioned employees into winter services like snow removal, allowing them to retain talent year-round.

If benefits such as health insurance, paid time off or financial incentives for certifications are offered, they should be clearly communicated to candidates. Many young workers are unaware of the long-term financial benefits that come with full-time employment. Employers who take the time to educate new lawn care employees on how to maximize these benefits will build stronger retention.

Create a healthy work culture

Workplace culture is a deciding factor. Gen Z wants to feel valued, heard and supported. Start by assessing company core values. Do they guide decision-making, or are they just words on a wall?

Businesses can foster a sense of connection by offering structured mentoring opportunities and encouraging tenured employees to take an active role in onboarding.

Team dynamics are just as important as pay when it comes to how to hire lawn care employees.

Words of Wilson features a rotating panel of consultants from Wilson360, a landscape consulting firm. Sheila Matthews is Chief People Officer of Wilson 360 and founder of Culture Pro, LLC. She can be reached at [email protected].

Reprinted with permission. GIE Media. Lawn & Landscape April 2025 (c)

The post 5 Ways to Hire Lawn Care Employees Efficiently appeared first on WILSON360.

]]>The post The Overlooked Strategy That Keeps Landscaping Clients Coming Back appeared first on WILSON360.

]]>That’s like signing up for an Ironman race with no training plan. Sure, you might have natural ability, but without structured preparation, coaching, and discipline, you’ll never reach peak performance. Coaches are constantly observing, refining, and tweaking techniques.

The Roadmap to Success

In The Ironman Mindset for Entrepreneurs, I emphasize the importance of a game plan—whether in sports, business, or leadership. Success in account management is no different. Just like in an Ironman race, the best account managers train for success by developing:

1. Vision: See Beyond the Next Sale

Good athletes don’t just focus on the next mile—they pace themselves for the long haul. A good account manager doesn’t just close deals; they nurture relationships, anticipate client needs, and create long-term value. Without vision, they’re just reacting instead of leading.

2. Strategy: Work Smarter, Not Harder

Ironman training is built on structured workouts—interval runs, recovery rides, and planned nutrition. The best account managers work with a proven playbook:

- Client check-ins aren’t random—they’re scheduled and purposeful.

- Follow-ups aren’t reactive—they happen before the client calls.

- Upsells aren’t aggressive—they’re solutions that create value.

3. Discipline: Show Up Every Day

Discipline is what separates an elite athlete from an amateur. In account management, discipline looks like this:

- Keeping detailed notes so you don’t ask the same question twice.

- Sending a follow-up email after every client meeting—even if nothing major was discussed.

- Tracking client satisfaction the same way you track operational efficiency and sales.

4. Coaching: The Power of Training

Even world-class athletes have coaches. Why? Because self-taught success has limits. Businesses that invest in structured training for account managers—not just sales reps—see massive payoffs in client retention, revenue, and internal efficiency.

The Hidden Cost of Not Training Your Team

A few years ago, I saw a multimillion-dollar landscape company lose one of its biggest clients. Why? Not because of poor service. Not because of pricing. The client walked out because their account manager failed to maintain the relationship.

- Calls went unanswered.

- Issues weren’t addressed proactively.

- The competition stepped in with better communication.

- Proactive solutions or enhancement ideas were not offered.

The company scrambled to recover, but it was too late by then. A trained account manager could have prevented this.

The actual cost of not training isn’t just losing one contract—it’s the long-term damage to your brand and revenue.

How Businesses Can Train Account Managers for Success

The solution isn’t complicated, but it requires commitment. If you want your team to succeed, treat them like Ironman athletes—equip them with a plan, train them consistently, and track their progress.

1. Audit Your Account Management Process

Take a hard look at your current system. Are account managers:

- Proactively engaging clients or just reacting to problems?

- Using a structured system for follow-ups, renewals, and upsells?

- Tracking client satisfaction beyond just retention?

2. Invest in Training & Coaching

Every great athlete has a training plan—and so should your account managers. Programs like NALP’s Account Manager Excellence and Wilson360’s account management or operational excellence training help them develop skills in:

- Client relationship-building

- Strategic upselling —reminders that they are investing in an ‘asset’.

- Problem-solving before issues escalate

3. Set KPIs & Hold Account Managers Accountable

If you don’t track progress, you won’t improve. Set clear performance metrics like:

- Client retention rate

- Revenue from enhancements

- Customer satisfaction scores

The best teams don’t just train—they measure and adjust. This is a continual process and is best done during renewal season, over the winter months.

Final Thoughts: Be the Business That Wins

An Ironman competitor doesn’t cross the finish line by accident—it takes planning, resilience, and discipline. Account managers don’t become high performers without training, mentorship, and a clear strategy.

At Wilson360, we train leaders to win—on job sites, in client meetings, and in the field. A high-performing account manager doesn’t just manage clients; they drive retention, growth, and profitability. Give them the training they need, and they’ll give your business a stronger future.

Want to build a stronger account management team? Wilson360 can help. Let’s talk.

About the Author

Serial entrepreneur, author, podcaster, and Ironman athlete Robert Clinkenbeard is CEO of green industry consultancy and peer group organization Wilson360. Connect with Robert at [email protected].

The post The Overlooked Strategy That Keeps Landscaping Clients Coming Back appeared first on WILSON360.

]]>